Third Consecutive Day of Market Purchases

Third Consecutive Day of Market Purchases

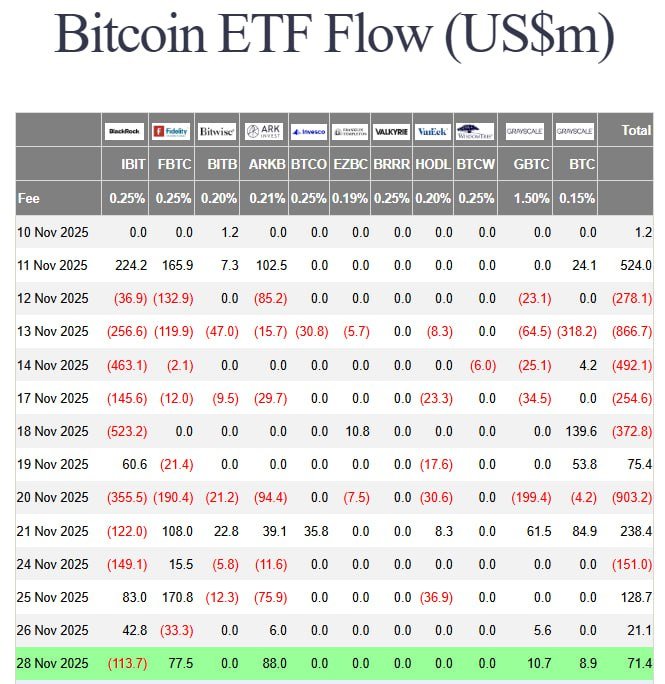

Markets registered the third consecutive day of net purchases as inflows continued across multiple asset classes, driven by investor repositioning.

Market dynamics

Equity and fixed-income funds recorded sustained buying patterns, while trading volumes remained within recent averages amid a cautious macroeconomic backdrop.

Analysts attribute the flows to tactical allocations, risk-on sentiment in specific sectors, and rotation from short-term cash positions into diversified portfolios.

Asset classes

Technology-related names and selected growth assets saw pronounced demand, reflecting expectations for continued earnings resilience despite mixed economic signals recently.

Fixed-income purchases concentrated on intermediate-duration instruments, with investors seeking modest yield pickup without substantially extending duration risk today and preserving liquidity.

Implications

The continued purchasing pattern may support asset valuations in the near term, while exposure concentrations warrant monitoring for potential sector-specific reversals.

Portfolio managers emphasized maintaining disciplined risk controls and liquidity buffers to accommodate abrupt changes in market sentiment without forced deleveraging.

Outlook

Market participants will watch upcoming economic releases and corporate earnings reports as determinants of whether buying momentum sustains beyond the third day.

Short-term outlook depends on macroeconomic data flow and central bank communications, which will define whether buyers maintain conviction or retreat to cash.

Investors tracking the trend should consider scenario planning across valuation, liquidity, and duration dimensions to limit downside in case of sentiment shifts.

Related posts